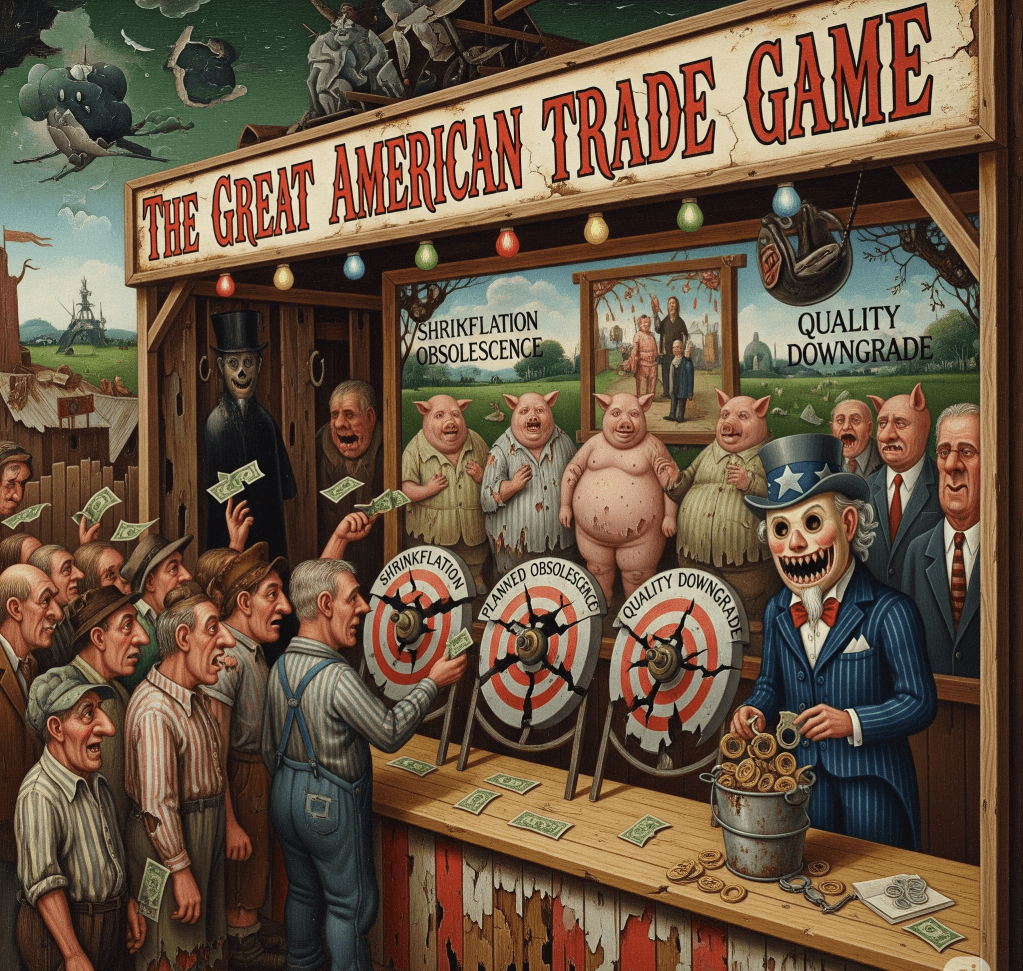

Imagine you walk into a carnival.

The barker promises you a game where you can’t lose. But no matter how closely you watch, the ball isn’t under the cup you picked—it was never there to begin with.

That’s Trump’s 2025 tariff plan in a nutshell.

Politicians will tell you these tariffs are a “punishment for China” or a “win for American workers.”

But here’s the cold, hard truth: Corporations don’t pay tariffs.

You do.

And they’ve gotten scary good at making sure you don’t realize it’s happening.

So how exactly will they pull off the greatest financial sleight-of-hand in recent history?

Buckle up.

The Corporate Playbook:

7 Dirty Tricks to Make YOU Foot the Bill

1. The “Invisible Shrink Ray” (Shrinkflation)

You know when you buy a bag of chips and suddenly it’s half air? Or when your “family size” detergent now washes five fewer loads?

That’s shrinkflation—companies quietly giving you less for the same price.

Under Trump’s tariffs, this may go into overdrive.

Your favorite products will get lighter, smaller, or weaker—while the price stays just steady enough that you don’t scream.

How They Get Away With It

The Slow Squeeze

- Companies shrink products gradually (e.g., 5% less cereal every 2 years) so most shoppers don’t notice.

- By the time you realize, the “old size” is long gone—and you’re stuck paying the same for less.

Distraction Tactics

- Brands redesign packaging (new colors, “improved formula!”) to hide the downsizing.

- They blame “higher costs” (tariffs, inflation) while pocketing bigger profits.

No Regulation

- The U.S. has no laws requiring companies to alert consumers about size reductions.

- Unit pricing (price per ounce) is often hidden or misleading in stores

Next time you shop, check the net weight.

You might be paying for air, water, or wishful thinking.

2. The “Bait-and-Switch Fee” (Junk Charges)

Get ready for the “Tariff Compliance Fee” or “Global Supply Chain Surcharge.”

These can appear at checkout like a ninja in the night.

You buy a $50 toaster. At checkout, suddenly:

- “Tariff Compliance Fee”: +$4.99

- “Global Supply Chain Surcharge”: +$3.50

Total: $58.49

And when you complain? “Blame the tariffs!”

This isn’t new.

Corporations have a long history of using external crises to squeeze customers while padding profits.

After the 2008 oil price spike, airlines and shipping companies slapped on permanent “fuel fees”—claiming they had no choice. But when oil prices crashed, the fees never went away.

Tariffs might add cents to production costs, but you’ll pay dollars in junk fees—while CEOs blame the policy instead of their greed.

3. The “Phantom Shortage” (Artificial Scarcity)

Corporations will suddenly discover “supply chain issues” that just happen to coincide with tariffs.

- “Sorry, your car parts are delayed… tariffs, you know?”

- “Oh no, we’re all out of that product… but we do have this more expensive version!”

How It Works

Companies create scarcity by slowing production, hoarding inventory, or “mysteriously” running out of cheaper options—then blame tariffs while steering you toward pricier alternatives.

Examples:

The Baby Formula Crisis (2022)

- After a major recall, just one factory shutdown led to nationwide shortages.

- But while parents scrambled, formula companies raised prices by over 18%—even as production ramped back up.

- The FTC found that corporate consolidation (just 4 firms controlling 90% of the market) made the crisis worse.

The Semiconductor “Shortage” (2020-2023)

- Automakers claimed chip shortages forced them to slash production.

- Yet Toyota, Ford, and GM made record profits—because they prioritized luxury trucks over affordable cars.

- Later, reports showed some companies cut orders too aggressively early on, worsening the “shortage.”

The Lumber Price Rollercoaster (2020-2022)

- Sawmills cited “supply chain chaos” as lumber prices tripled.

- But when prices crashed in 2023, mill operators admitted they’d slowed production to keep profits high.

The Pattern?

- Real disruptions happen—but corporations exploit them longer than necessary.

- You pay more for less, while investors get told: “We’re managing supply for profitability.”

4. The “Geographic Illusion” (Fake Offshoring)

Companies will play tariff hopscotch—moving one tiny step of production to Vietnam or Mexico while still getting 90% of their parts from China.

Then they’ll slap a “Made in Malaysia” sticker on it and charge you extra for the “privilege” of avoiding tariffs.

How It Works

Assembly-Line Arbitrage

- A company shifts final assembly to a tariff-exempt country (like Vietnam or Mexico).

- But all the key components still come from China—just repackaged to dodge import taxes.

- Result? The product is technically “Made in Vietnam,” but it’s still Made in China, Plus a Layover.

The Paperwork Shell Game

- Corporations exploit “substantial transformation” loopholes in trade laws.

- Example: If a Chinese-made circuit board gets a single screw added in Malaysia, it can be relabeled as Malaysian—even if 99% of the value is still Chinese.

Example:

The “Vietnamese” Solar Panels Scam (2022-Present)

- To avoid U.S. tariffs on Chinese solar panels, companies like LONGi and JinkoSolar began shipping Chinese-made cells to Vietnam for minor processing.

- They were then labeled “Vietnamese” and imported tariff-free—until U.S. investigators caught them red-handed in 2023.

- Outcome? A slap-on-the-wrist fine, while the loophole remains wide open.

Why Are There No Laws Stopping This?

Corporate Lobbying Power

- Big businesses spend millions to keep trade loopholes vague.

- Example: The Consumer Technology Association (CTA)—representing Apple, Samsung—lobbied hard to weaken “country of origin” rules in the updated United States-Mexico-Canada Agreement (USMCA).

Regulators Are Outgunned

- Customs agencies don’t have the resources to track every component’s real origin.

- Companies hire specialist law firms to structure deals that look legal on paper.

You’re Kept in the Dark

- No law requires brands to disclose what % of a product is actually made in the labeled country.

- Even “Made in USA” labels can be mostly foreign—as long as “final assembly” happens stateside.

In the near-term future, you may end up paying more for the same Chinese-made goods—now with extra steps.

5. The “Exemption Swindle” (Lobby, Then Gouge)

Big corporations will cry to Congress for special tariff exemptions—then turn around and raise prices anyway.

- “Oh, thank goodness we got that waiver! Now let’s bump up prices 12% ‘due to inflation.“

How This Works

Step 1: Beg for Relief

- Companies lobby hard for exemptions, claiming tariffs will force layoffs, higher prices, or shortages.

- They hire former government officials to push their case, exploiting insider connections.

Step 2: Pocket the Savings

- Once they get the exemption, they keep prices the same (or even raise them), blaming other “cost pressures.”

- Investors get told: “We’re managing pricing for margin recovery.” (Translation: We’re charging you more because we can).

Step 3: Never Pass It On

- There’s no rule requiring companies to lower prices if tariffs are lifted.

- Consumers never see the savings—they just get a new excuse for price hikes.

Example:

The Steel Tariff Exemption Racket (2018-2020)

- After Trump’s steel tariffs, hundreds of companies (including major automakers) begged for exemptions.

- Ford got waivers on some imported steel, claiming tariffs would raise car prices.

- Result? They kept prices rising anyway, blaming “supply chain costs” while posting record profits.

6. The “Pay More, Get Less” (Skimpflation)

Your favorite products will start cutting corners:

- Thinner toilet paper

- Weaker coffee blends

- Slower customer service

But the price? Oh, that’s still going up.

How Skimpflation Is Different From Shrinkflation

Shrinkflation = Companies give you less product (smaller package, fewer items) for the same price.

Example: Your cereal box shrinks from 16oz to 14oz, but the price stays $4.99.

Skimpflation = Companies make the product cheaper/worse (lower-quality ingredients, reduced service) while keeping the same packaging and price.

Example: Your favorite ice cream now uses artificial thickeners instead of cream—same tub, same price, worse taste.

How Companies Get Away With It

The “Recipe Adjustment” Trick

- Brands change formulas just enough to cut costs (adding wood pulp to toilet paper).

The Bait-and-Switch

- Keep the brand name and packaging identical so you don’t suspect downgrades (a “premium” ice cream quietly replaces cream with vegetable oil).

No Legal Standards

- Even terms like “all-natural” are barely regulated—letting companies degrade quality legally.

Why There Are No Laws Stopping This

Corporate Lobbying

- Big brands fund politicians who block consumer protection laws.

- Example: The food industry spent $38M in 2023 to kill GMO labeling rules.

Regulatory Blind Spots

- Agencies like the FTC don’t monitor product formulas—only outright fraud.

- If it’s not dangerous, it’s legal—even if it’s a rip-off.

You Can’t Sue What You Don’t Know

- Without side-by-side testing, most skimpflation is invisible until it’s too late.

7. The “Subscription Trap” (You Will Own Nothing)

Why sell you a product once when they can charge you forever?

- Your basic toaster now requires a $4.99/month ‘premium heating’ plan.

- “Unlock ‘fast charging’ on your phone… for a small fee.”

How This Works

The Shift From Ownership to Rentals

- Companies disable hardware features (like faster charging) unless you pay a monthly fee.

- Even physical products (appliances, cars) now come with mandatory software subscriptions.

Tariffs as an Excuse

- When tariffs raise production costs, companies don’t just absorb them—they invent new ways to bill you.

- Example: A company facing higher import fees on smart TVs might:

- Sell the TV at the same price but lock basic functions behind a paywall.

- Claim “new supply chain costs forced us to introduce a subscription model.”

No Consumer Protections

- Right-to-Repair laws are weak—companies can legally block access to features you already paid for.

- No FTC rules stop companies from turning one-time purchases into permanent revenue streams

Why There Are No Protections

Corporate Lobbying

- Big Tech and manufacturers spend millions to kill laws that would ban predatory subscriptions.

- Example: John Deere spent $2M in 2023, where a portion went to lobbying against right-to-repair bills.

Regulators Move Too Slowly

- The FTC is just starting to investigate “dark patterns” (tricks to force subscriptions).

- By the time they act, the scheme is already everywhere.

You Don’t Realize It’s Happening

- Companies roll out subscriptions gradually (first “optional,” then mandatory).

- By the time you notice, it’s too late—you’re locked in.

Example:

BMW’s Heated Seats Scam (2022-2023)

- BMW started selling cars with pre-installed heated seats—but you had to pay $18/month to turn them on.

- They blamed “global chip shortages and tariffs” for the new model.

- Backlash forced them to walk it back—but the subscription model is still spreading (Mercedes now charges $120/year for faster acceleration).

Why Companies Deploy This Tactic When Tariffs Loom

Tariffs cut into profit margins—but corporations won’t accept smaller bonuses. Instead of absorbing costs or competing fairly, they see tariffs as an opportunity to fundamentally change the rules. By shifting to subscriptions, they:

- Lock in guaranteed revenue (monthly fees are more predictable than one-time sales).

- Hide the true cost (you’ll focus on the $9.99/month, not the 400% markup over time).

- Exploit the chaos—when headlines scream about tariffs, they quietly slip in new fees, knowing you’ll blame policymakers instead of boardrooms.

The goal? Turn temporary tariffs into permanent profit streams—all while pretending they had “no choice.”

Why This Is Worse Than You Think

Tariffs are like economic steroids—they might make certain industries look stronger in the short term, but they’re slowly poisoning the entire system. When you force American consumers to pay artificially high prices for domestic goods by blocking cheaper foreign alternatives, you’re not creating strength; you’re creating dependency.

This isn’t just about paying a few extra bucks for sneakers or TVs. Tariffs are economic quicksand—the more you struggle, the deeper you sink.

The Immediate Damage:

- Prices spike on everything (even stuff “Made in America” that relies on imports).

- Wages don’t keep up, so your paycheck buys less.

- Small businesses get crushed (they can’t dodge tariffs like Amazon can).

The Long-Term Disaster:

- Jobs vanish as companies automate or flee overseas.

- Innovation dies because trade wars strangle competition.

- China wins anyway—they’ll just sell to other countries while we pay the tax.

The Biggest Lie of All?

Trump’s team will tell you this is “patriotic economics.” But ask yourself:

- Why do Walmart’s profits soar while your grocery bill doubles?

- Why do CEOs get richer while your paycheck stagnates?

Because this was never about helping you.

It’s about making you think you’re winning – while they rig the game in their favor.

The Bottom Line: Don’t Fall for the Con

We’ve seen this movie before.

Trump’s 2018 tariffs cost Americans $50 billion—with zero manufacturing revival to show for it.

Why Tariffs Fail to Revive American Manufacturing:

They Don’t Address the Root Problem

Tariffs make imports more expensive, but they don’t make U.S. factories more competitive. Labor costs, automation gaps, and supply chain dependencies still push production overseas. Example: After 2018 steel tariffs, U.S. manufacturers cut jobs because higher steel prices made their exports uncompetitive.

Trade Wars Backfire

Retaliatory tariffs hurt U.S. exports. In 2018, China’s counter-tariffs crushed American farmers ($27B in bailouts proved it). Manufacturing requires global supply chains—disrupting them just raises costs.

The Automation Trap

Even if production returns, robots (not workers) get the jobs. U.S. manufacturing output rose post-2018, but employment stagnated—because companies automated to offset tariff costs.

In 2025, we’re not just facing higher prices—we’re staring down the barrel of a complete restructuring of American economic life, and most people don’t even see it coming.

The Permanent Damage This Creates

The tariff regime being implemented isn’t a temporary policy adjustment; it’s a fundamental shift toward economic isolationism that will reshape how Americans live, work, and spend for decades to come.

Every tariff creates a new constituency that benefits from keeping those barriers in place. Once established, these protection rackets become nearly impossible to dismantle because the protected industries will fight tooth and nail to keep their government-subsidized advantages.

This creates a vicious cycle:

- Higher prices lead to demands for higher wages.

- Higher wages make American products even less competitive internationally.

- Less competitiveness leads to calls for even higher tariffs to protect domestic industries.

- It’s economic quicksand—the more we struggle, the deeper we sink.

Why “I’m Willing to Pay More to Rebuild America” is Wrong

Now, here’s where we need to address the elephant in the room.

Many Americans are saying, “I’m okay paying a bit more for products if it means rebuilding America’s economic might.”

This sounds noble, even patriotic.

But it’s based on a fundamental misunderstanding of how modern economies actually work.

Here’s the hard truth: you’re not “investing” in American strength — you’re subsidizing American weakness.

Real economic might come from companies that can compete and win in global markets, not from companies that need government protection to survive.

Consider the evidence:

- South Korea’s automotive success: They didn’t ban foreign cars and force Koreans to overpay for inferior domestic vehicles. They forced their companies to compete internationally until they were good enough to sell Hyundais and Kias all over the world.

- Germany’s post-WWII recovery: They rebuilt by forcing their industries to compete at the highest levels, not by hiding behind protective walls.

- Japan’s miracle (1950s–1980s): No tariffs. Instead, they banned most foreign products temporarily (e.g., cars until 1965) to force innovation. Companies like Toyota had to export or die—no domestic handouts. Result: From cheap knockoffs to Lexus in 30 years

The “pay more to rebuild America” argument is like forcing a Little League team to buy $500 bats from the coach’s brother—while he pockets $450 per sale and tells the kids it’ll make them “tougher.”

- The scam: Prices soar, quality doesn’t improve, and the coach’s family gets rich.

- The reality: Real champions train with the best tools available (like German/Japanese firms do globally).

Tariffs work the same way: They let corporations charge monopoly prices for inferior products, then call it “patriotism.”

“But China Pays!”

→ Fact: The IMF found 90%+ of U.S. tariff costs were borne by Americans. China just sold to other markets. Most U.S. tariffs hit American importers (even foreign-owned subsidiaries), who then pass costs to U.S. consumers—while foreign exporters just redirect sales to untaxed markets.

“It Worked in the Past!”

→ Context: 20th-century tariffs worked because the U.S. had no rival manufacturing base. Today, globalized supply chains make that impossible to reverse overnight.

But Wait — What About The Federal Reserve Lowering Interest Rates To Make Our Exports Cheaper?

Yes, lower rates can weaken the dollar and boost export competitiveness—that part is economically sound.

But here’s why it won’t save us from tariff damage:

+ The Inflation Double-Whammy:

Tariffs already push up domestic prices. Lower interest rates add more inflationary pressure. You might get cheaper exports but everything Americans buy gets more expensive faster.

Winners: Export companies and their shareholders.

Losers: Every American family watching their grocery bills skyrocket while their wages stay flat.

+ Currency Manipulation Wars:

If we deliberately weaken our dollar other countries will respond by weakening theirs. It becomes a race to the bottom where no one actually gains lasting advantage.

Winners: Currency traders making money on volatility.

Losers: American businesses trying to plan investments when they can’t predict what their costs will be next quarter.

+ The Timing Problem:

Interest rate effects take 12-18 months to fully work through the economy, while tariff price increases hit immediately. You’re asking families to suffer now for theoretical benefits later.

Winners: Politicians who can promise future prosperity.

Losers: Working families who need to pay rent and buy groceries today, not in 2026.

Who Really Gets Hurt

The most tragic part?

The Americans who will suffer most from this policy are often the same ones who were promised it would help them:

- Working families spending 15-20% of their income on goods that will see immediate price increases.

- Small business owners who rely on imported materials watching their profit margins evaporate.

- Retirees on fixed incomes discovering their purchasing power has been quietly redistributed to protected industries.

We’re essentially imposing a massive regressive tax on ourselves while calling it economic patriotism.

What’s a regressive tax? It’s a cost that hits lower-income Americans hardest, while wealthier people and corporations barely feel it.

Tariffs work the same way:

+ You Pay, They Profit

A 25% tariff on Chinese goods might add $200 to a $800 fridge—a crushing cost for a family budgeting paycheck-to-paycheck.

But Walmart raises the price $300, pockets the difference, and its CEO still gets a $20M bonus.

+ The Ripple Effect

Factories facing tariff costs cut jobs before they cut executive pay.

Example: Harley-Davidson shifted production overseas after 2018 tariffs—while giving shareholders $700M in buybacks.

+ Corporate Welfare

Big companies lobby for exemptions (see: “The Exemption Swindle”), while small businesses eat the cost.

Result? A local toy store closes because it can’t afford tariff-hit inventory, but Amazon gets a waiver and dominates even harder.

Patriotism Isn’t a Sticker – It’s a Standard

The impulse to rebuild American industry is right – but this isn’t how you do it. Real patriotism would mean:

- Demanding transparency – Next time you shop, check labels and ask: “Where was this actually made?”

- Supporting actual American manufacturers – Seek out companies that disclose supply chains.

- Voting with your wallet – When corporations blame tariffs for price hikes while posting record profits, walk away.

President Trump isn’t wrong that America needs renewal – but his version enriches golf buddies and Mar-a-Lago donors while leaving you with the bill.

True economic patriotism starts with holding both corporations and politicians accountable.